Navigating Roof Insurance Claims: How to Get a Roof Insurance Claim Approved

Navigating the complexities of roof insurance claims can be challenging for homeowners. Increasing your chances for a successful roof insurance claim involves a proactive approach to inspections and assessments. From conducting regular roof maintenance inspections to understanding the details of your property insurance evaluation, each step plays a vital role in ensuring that claims are approved.

Understanding the necessary inspections, such as roof damage assessments and insurance coverage evaluations, equips homeowners with the knowledge needed to act swiftly and efficiently. Regular roof safety inspections and maintenance can mitigate potential damage before it becomes a significant issue, strengthening your position when filing a claim.

Ultimately, staying informed about building insurance protocols and engaging in thorough evaluations are key aspects that contribute to a smooth claims process. By prioritizing these actions, you can enhance your ability to secure the coverage you need following any roof-related incidents.

Understanding Roof Insurance Claims

Navigating roof insurance claims requires knowledge of basic procedures and a clear understanding of insurance coverage. Knowing these elements can significantly improve the outcome of your claim.

Understanding Roof Insurance Claims

Navigating roof insurance claims requires knowledge of basic procedures and a clear understanding of insurance coverage. Knowing these elements can significantly improve the outcome of your claim.

Roof Insurance Claim Basics

A roof insurance claim can be initiated when roof damage occurs due to covered perils, such as storms or fire. Homeowners should report the damage promptly to their insurance provider.

Key steps in the process include:

- Documenting Damage: Take clear photos of any damage. This provides visual evidence for the claim.

- Reviewing Policy: Understand your policy details to know what is covered and any exclusions that may apply.

- Professional Assessments: Inspections from licensed roofing contractors can help substantiate your claim and provide an accurate damage report.

These steps will ensure that the insurance company receives all necessary information to process the claim efficiently.

Importance of Insurance Coverage Evaluation

Evaluating your insurance coverage is crucial for effective claims handling. Ensure your policy includes adequate coverage for roof damage, which can vary based on the type of roof and materials used.

Consider the following factors:

- Replacement Cost vs. Actual Cash Value: Understand whether your policy covers full replacement costs or if it factors in depreciation.

- Deductibles: Know your deductible amount; this impacts how much you'll receive after a loss.

- Exclusions: Familiarize yourself with any specific exclusions, such as wear and tear or lack of maintenance.

Regularly reviewing your policy can help maximize your insurance benefits when damage occurs.

Pre-Claim Roof Inspection

A pre-claim roof inspection is critical to identify potential issues before filing an insurance claim. It includes several key assessments to ensure the roof's condition meets insurance requirements and maximizes the chances of a successful claim.

Roof Maintenance Inspection

Regular roof maintenance inspection is essential for catching minor issues before they escalate. This inspection includes checking for missing shingles, damaged flashing, and algae growth. Identifying these factors early can prevent costly repairs and strengthen your position during an insurance claim.

Maintaining a detailed log of maintenance activities, including photographs and dates, can support your claim. Insurance companies appreciate a proactive approach to upkeep, which demonstrates responsible homeownership. This documentation can validate your case if issues arise.

Roof Damage Assessment

Conducting a thorough roof damage assessment is vital after a storm or any noticeable wear. This assessment should focus on visible signs like leaks, cracks, and structural damage. Documenting these issues with photographs will provide important evidence for your claim.

Be cautious about climbing onto the roof yourself; consider hiring a professional inspector if needed. They can identify hidden damage not easily seen from the ground. A detailed report can substantiate any claims you may need to make regarding severe damage.

Roof Protection Inspection

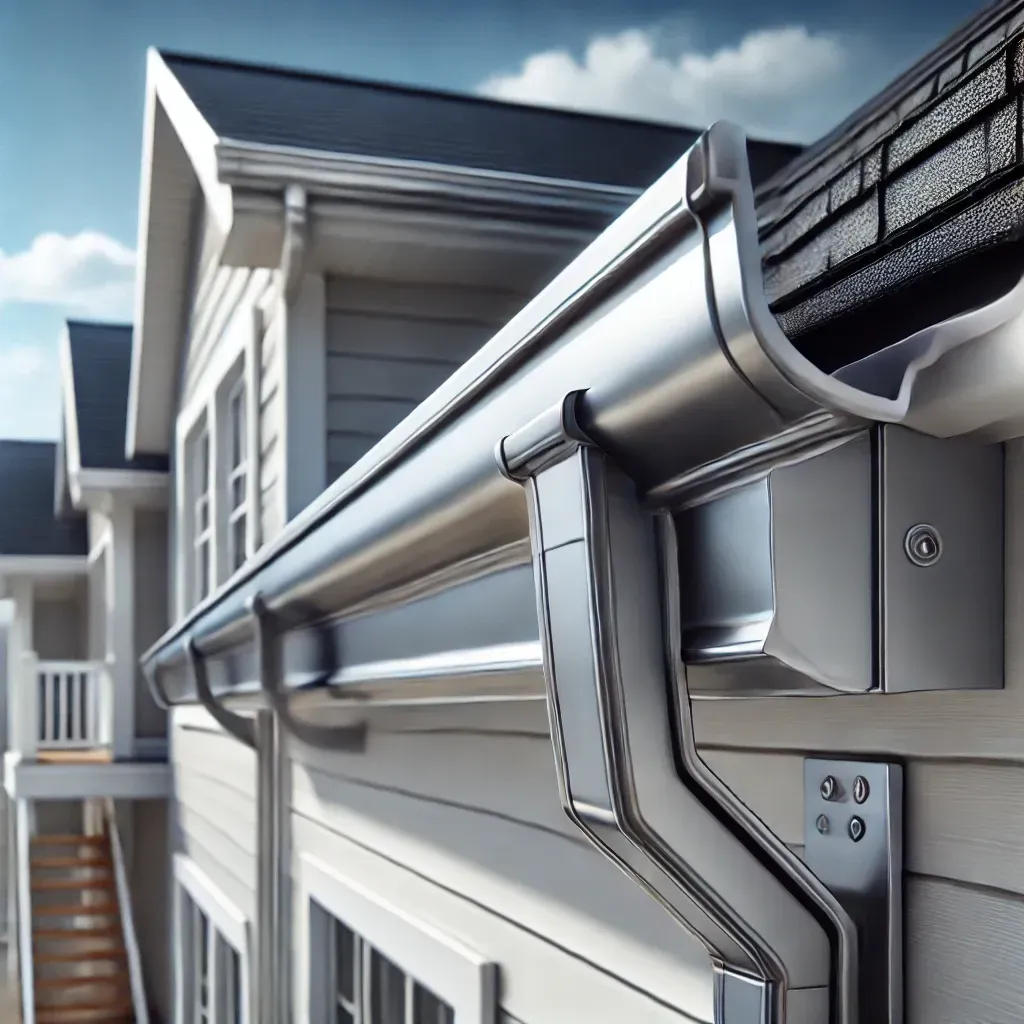

A roof protection inspection examines the measures in place to defend your roof against future damage. This may include checking gutter systems, downspouts, and roof coverings. Proper drainage and debris removal increase the roof's lifespan and can minimize insurance claims.

Look for proper sealing and waterproofing measures around vents and chimneys. Ensure that any protective features are functioning effectively. Providing evidence of roof protection can demonstrate your commitment to maintaining the property.

Roof Safety Inspection

Roof safety inspections focus on identifying hazards that may pose risks during any necessary repairs or assessments. Inspect for loose tiles, weak areas, or structural vulnerabilities. This inspection helps secure the safety of anyone who may need access to the roof.

Ensure that all safety measures align with local regulations and industry standards. This includes properly installed guardrails and stable ladders. Ensuring safety is not just a precaution; it can be a factor in how insurers view your proactive measures when you claim for damages.

Filing the Roof Insurance Claim

Successfully filing a roof insurance claim entails following specific protocols and navigating your property insurance evaluation effectively. Understanding these elements can significantly increase the chances of approval for your claim.

Insurance Claim Assessment Protocol

Before filing a claim, familiarize yourself with the insurance claim assessment protocol mandated by your provider. Gather all relevant documentation, including photos of the damage, the date of the incident, and any maintenance records.

- Review your policy: Understand what is covered and the applicable deductibles.

- Compile evidence: Collect receipts and invoices for repairs or replacement work.

- Contact your insurer: Report the damage as soon as possible and provide them with your collected documents.

The insurer will then assign an adjuster to assess the damage. Be prepared to answer questions and provide additional information if needed.

Navigating Property Insurance Evaluation

Navigating the property insurance evaluation process is crucial for claim success. Start by understanding the specifics of your policy and the criteria for coverage.

- Contact the insurance company to discuss the evaluation process.

- Schedule an inspection: Your insurer may conduct its own assessment of the damage.

- Document recommendations: If the adjuster recommends repairs, make sure to ask for a detailed report.

Keep detailed records throughout this process. This includes notes from conversations and copies of any correspondence. If you disagree with the findings, you may challenge the evaluation within the stipulated timeframe. Knowing your rights can help you advocate for a fair outcome.

Post-Claim Inspections and Evaluations

Effective post-claim inspections are crucial for a successful insurance claim process. They ensure that the damages are assessed accurately and help in gathering necessary documentation to support the claim.

Home Insurance Inspection after a Claim

A home insurance inspection conducted after filing a claim plays an essential role. This inspection reviews the specific damages that occurred, confirming the extent of loss and validating the claim's legitimacy.

Insurance adjusters typically focus on crucial areas such as:

- Structural damage: Walls, beams, and ceilings

- Roof integrity: Shingles, flashing, and underlayment

- Interior damage: Water stains, mold, and other impairments

Documenting these findings with clear photographs and detailed notes can benefit the claim process significantly. Accurate records will enhance leverage during negotiations with the insurance company.

Residential Insurance Inspection for Claim Support

A residential insurance inspection aims to gather supporting evidence for the claim. This inspection focuses on specific categories of damage listed in the claim.

Key aspects of the inspection include:

- Systematic evaluation of identified damages

- Comparative analysis with previous inspections

This structured approach ensures that all damages are documented and evaluated systematically. The outcome of this inspection often influences the extent of the compensation received, underlining the importance of thorough evaluation.

Building Insurance Inspection for Structural Integrity

Inspections for building insurance focus on assessing structural integrity post-claim. This helps identify not just the visible damage but also any underlying issues that could impact safety.

Inspectors look for:

- Foundation cracks

- Load-bearing wall issues

- Roof stability

By addressing these concerns, this inspection allows homeowners to ensure safety and compliance with local codes. Such detailed evaluations can also provide additional insights into any adjustments needed for future repairs.

Conclusion

Successfully navigating the roof insurance claim process requires careful preparation and attention to detail.

Big T Construction has helped dozens of customers who were denied by their insurance companies for their rightful claim. By our crew being present for the insurance inspection, we point out to the inspector exactly why and how a weather event caused specific damage to your property.

- Start with regular home insurance inspections to identify potential issues early. This proactive approach minimizes surprises during claims.

- Conduct thorough roof damage assessments to document conditions accurately. Capture photographs and notes before making any repairs.

- Evaluate your property insurance coverage. Understanding the specifics of your policy can save time and reduce confusion during claims.

- Regular roof maintenance inspections help in maintaining the roof's integrity. Clear debris and check for issues that could lead to larger problems.

- Prepare for an insurance claim assessment by gathering necessary documents. This includes inspection reports and evidence of damage.

- Consider roof protection inspections to mitigate future risks. These inspections assess vulnerabilities and recommend improvements.

- Engage in both residential and building insurance inspections as needed. Each type covers different aspects crucial for a comprehensive evaluation.

- Implement a roof safety inspection to ensure compliance and safety standards. This can prevent accidents and support your claims process.

- Finally, regularly revisit your insurance coverage evaluation to adapt to changes in your property or local regulations. Being informed strengthens your position in any claim scenario.

Ready to work with

Big T Construction?

Let's connect! We’re here to help.

Send us a message and we’ll be in touch.

Or give us a call today at 816-447-0513

Agency Contact Form

More Marketing Tips, Tricks & Tools

Big T Construction Blog